How it works

Your PDF Document

Print, and Share

It Legally Binding

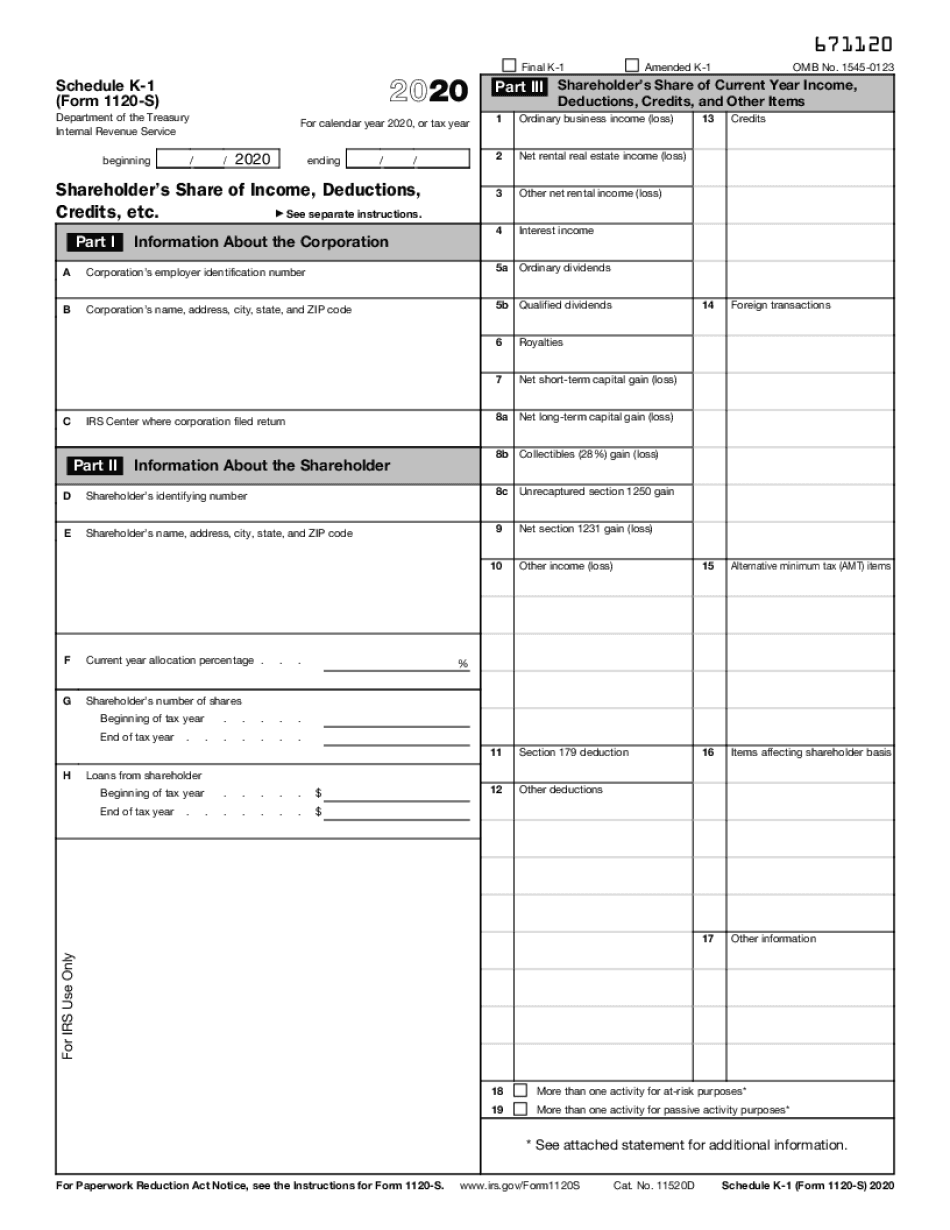

What is Schedule K 1 Form Form 1120-s?

After filing Form 1120S, each shareholder is provided a Schedule K-1 by the corporation. The K-1 reflects a shareholder's share of income, deductions, credits and other items that the shareholder will need to report on their individual tax return (Form 1040).

How to Delete Pages in Schedule K 1 Form Form 1120-s

Portable Document Format is the most convenient way to exchange information. any device, regardless of its operating system, can open a PDF. The key point is the layout is page-structured and looks the same every time. This way, you can Delete Pages in Schedule K 1 Form Form 1120-s knowing that the appearance won't change even when you print it. However, editing this format can be a daunting task and cause difficulties that our editor, fortunately, quickly solves. Read the guide on how to Delete Pages in Schedule K 1 Form Form 1120-s and get started:

Double-check the file before saving or sending it. If you see any error, delete the incorrect data and refill the corresponded field without wasting time. No matter how many mistakes you find, they can all be fixed with clicks. Check out the solution now to process the file seamlessly.

Advantages to Delete Pages In Schedule K 1 Form Form 1120-s here

If you are tired of the daily manual work with documents, then our solution spares you from all the difficulties. You can [Function Name] Schedule K 1 Form Form 1120-s from your device at any time without installing applications or searching for software. Our service helps you save time by managing your PDFs quickly and easily. Take advantage of the platform that provides you with sought-after and easy-to-use tools to cope with document issues in no time. Also, explore the merits of the solution and make sure it works for you.