How it works

Your PDF Document

Print, and Share

It Legally Binding

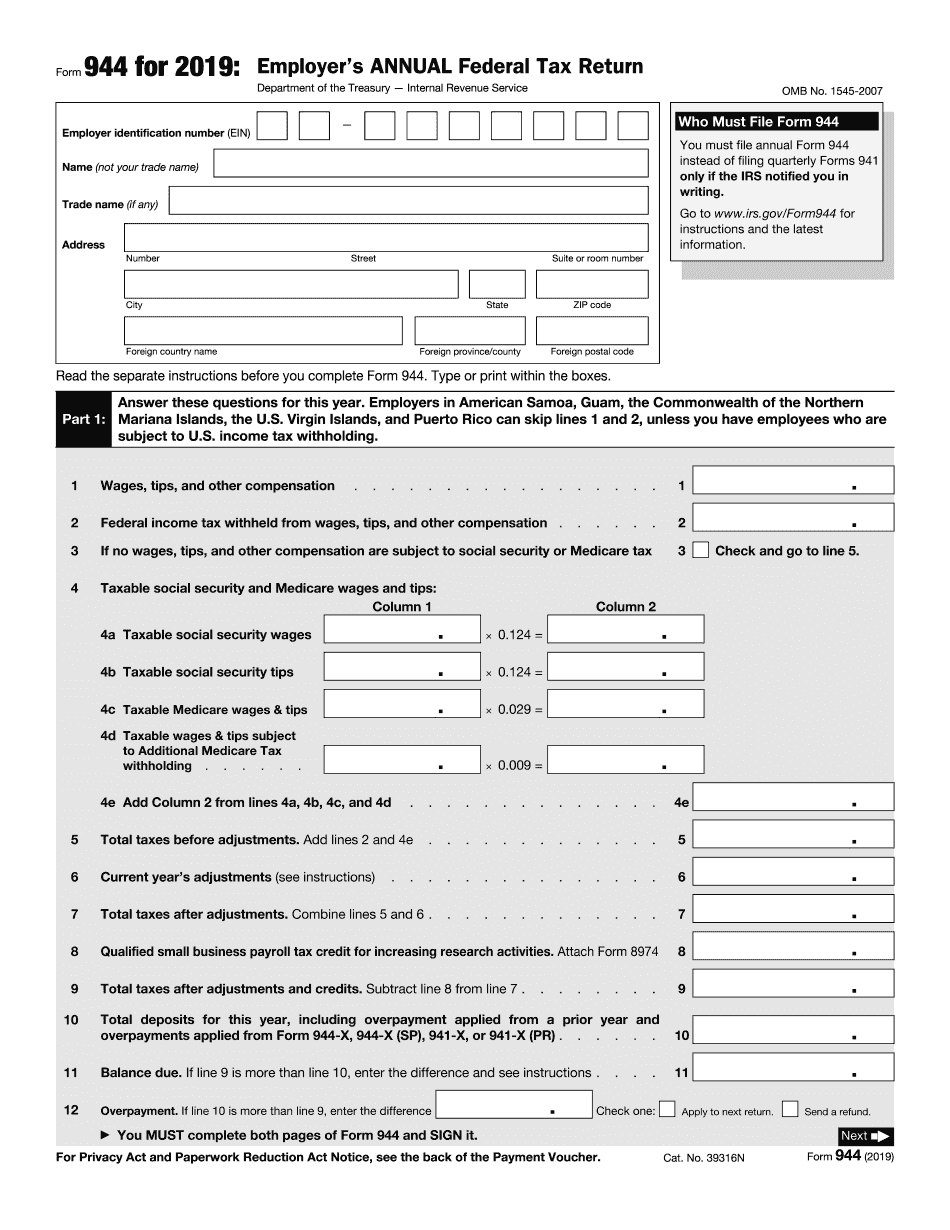

What is Form 944?

You must file Form 944 if the IRS has notified you to do so, unless you contact the IRS to request, and receive written notice, to file quarterly Form 941 instead. This is true even if your employment taxes for the year will be over $1,000.

How to Delete Pages in Form 944

Work on documents online hassle-free, leaving software installation, downloads, and other follow-ups behind. Our web-based editor offers you all the tools you might need to enhance records. Using the solution, you can manage, modify, and Delete Pages in Form 944 without extra steps. Follow the guidelines below to check it out and find out more benefits:

Make the most out of the service to put in order a flexible editing workflow. Process documents and Delete Pages in Form 944 in clicks using the cross-platform solution from any device. Now, to cope with the paperwork and burdensome tasks, you need only a strong internet connection. Throw the piles of papers that clutter your workplace away and keep all files at your fingertips from anywhere, anytime.

Advantages to Delete Pages In Form 944 here

Don't waste time comparing a dozen solutions. Try our service and find out how to Delete Pages In Form 944 in the most straightforward way. You can get access to the toolkit and say goodbye to all PDF-related issues. Our online solution helps you edit content as you like seamlessly and create good-looking documents via your device without extra software. Build a workflow where you can feel free to focus on important things for you and your business while our platform supplies you with everything else: