How it works

Your PDF Document

Print, and Share

It Legally Binding

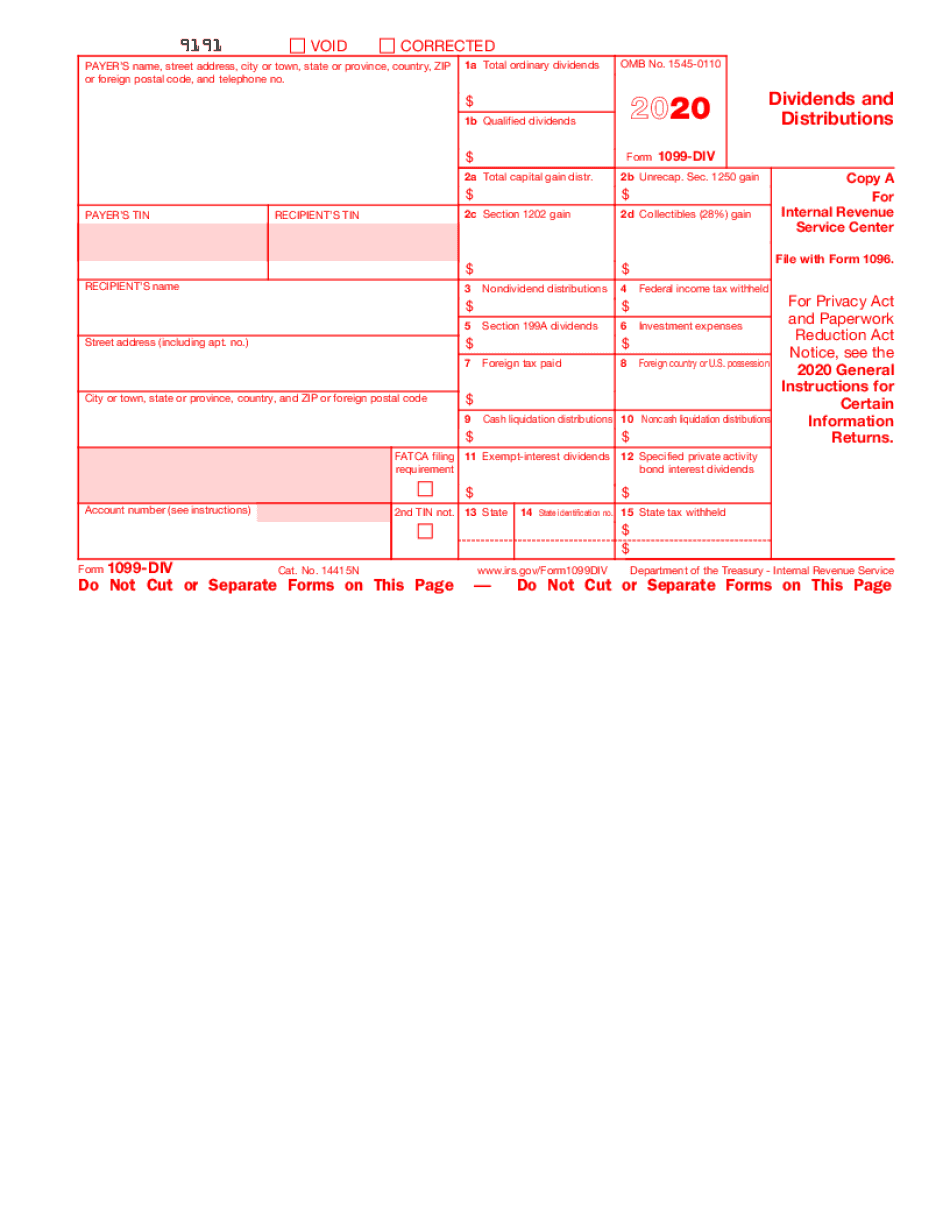

What is 1099-div Form?

If you receive $10 or more in dividends, you will receive a Form 1099-DIV. This form shows the dividends you received, any taxes withheld, non-dividend distributions, capital gains distributions, investment expenses, and certain other types of gains. You will need to report this income on your tax return.

How to Delete Pages in 1099-div Form

Try out the fastest way to Delete Pages in 1099-div Form without printing. Launch our web-based editor via any browser regardless of your device and operating system. The solution provides you with a full-featured toolkit to simplify and facilitate editing. Look at the step-by-step instructions below and find out how to take advantage of the features:

Feel confident when managing documents via our editor, knowing that the solution is GDPR- and ESIGN- compliant. Prepare your PDF in clicks, Delete Pages in 1099-div Form , modify existing content, and add a new one to cope with red tape using a secure and reliable workflow.

Advantages to Delete Pages In 1099-div Form here

Our solution helps you work with PDFs hassle-free. Explore the platform capabilities and benefits for a seamless workflow. Boost efficiency and Delete Pages In 1099-div Form in clicks. Instead of working hard to fix documents, focus on your goals and instantly solve any PDF-related problem. Get rid of annoying bureaucracy and enjoy a robust document turnaround. Manage files, process data, and work from anywhere in the fastest and most straightforward way. Check out the other advantages and find out that the service brings you: